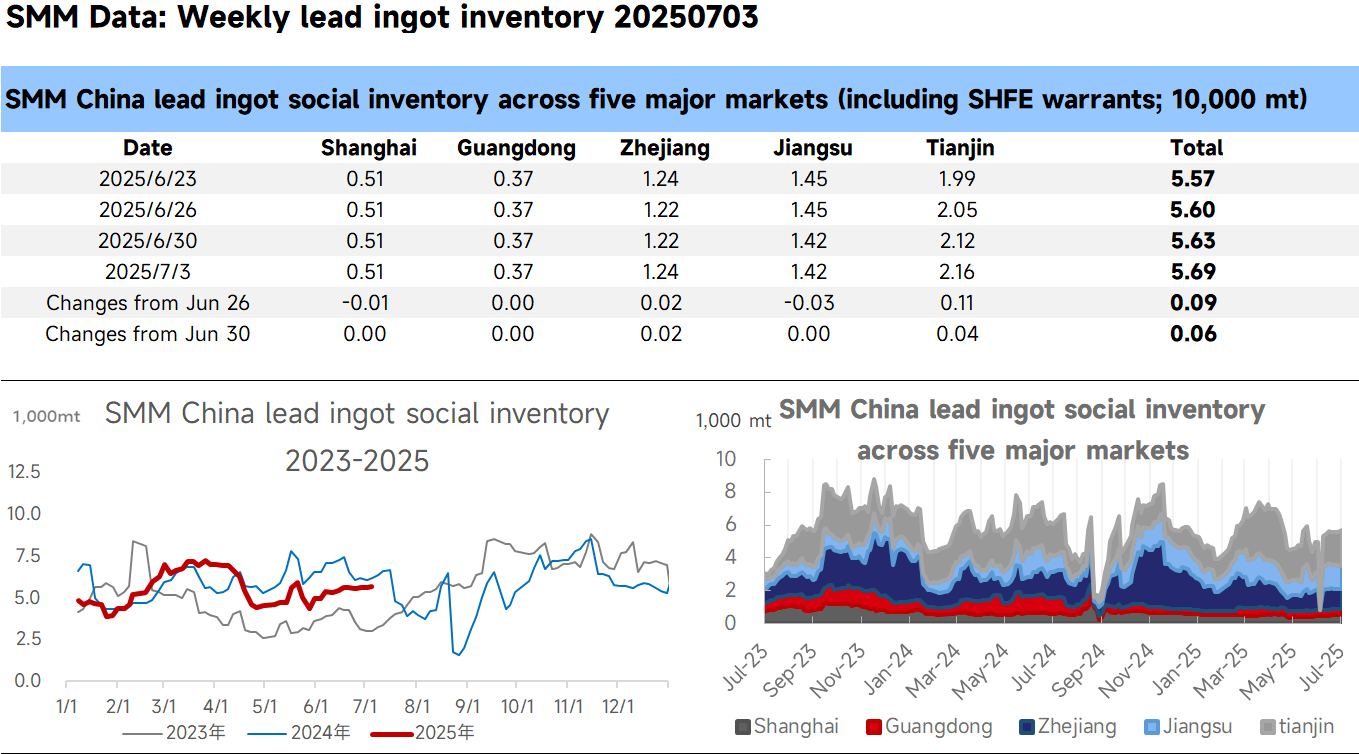

SMM News on July 3: According to SMM, as of July 3, the total social inventory of lead ingot across five regions tracked by SMM reached 56,900 mt, an increase of approximately 900 mt from June 26 and approximately 600 mt from June 30.

This week, lead prices have held up well, with the overall center of price movement shifting upwards. Suppliers have been actively selling their stocks, leading to an expansion in spot discounts for lead. The price spread between futures and spot prices for lead from major producing areas ranges from 180 to 250 yuan/mt. During this period, suppliers intended to transfer their stocks to delivery warehouses. However, given that the delivery date is still some time away, they have focused more on selling to downstream enterprises. These enterprises have purchased according to their needs and have shown interest in receiving some cargoes with large discounts. As a result, the inventory in social warehouses has only increased slightly. In July, with the conclusion of maintenance at lead smelters, the supply of lead ingot is expected to rise. Meanwhile, as lead consumption enters the transition period between the off-season and peak season, downstream demand is expected to improve relatively. It is anticipated that amid simultaneous growth in supply and demand, there will be no significant expectation of inventory buildup for lead ingot. Additionally, it is worth noting that next week is the week preceding the delivery of the SHFE lead 2506 contract. Given the relatively large spread between futures and spot prices, we still need to pay attention to the possibility of social inventory buildup resulting from the transfer of some delivery brand cargoes to warehouses.